September 23, 2008

Why John McCain Wasn't Able to Avert the Economic Train Wreck Now

. . . however he tried in 2005. Kevin Hassett in Bloomberg:

Sept. 22 (Bloomberg) -- The financial crisis of the past year has provided a number of surprising twists and turns, and from Bear Stearns Cos. to American International Group Inc., ambiguity has been a big part of the story.Why did Bear Stearns fail, and how does that relate to AIG? It all seems so complex.

But really, it isn't. Enough cards on this table have been turned over that the story is now clear. The economic history books will describe this episode in simple and understandable terms: Fannie Mae and Freddie Mac exploded, and many bystanders were injured in the blast, some fatally.

Fannie and Freddie did this by becoming a key enabler of the mortgage crisis. They fueled Wall Street's efforts to securitize subprime loans by becoming the primary customer of all AAA-rated subprime-mortgage pools. In addition, they held an enormous portfolio of mortgages themselves.

In the times that Fannie and Freddie couldn't make the market, they became the market. Over the years, it added up to an enormous obligation. As of last June, Fannie alone owned or guaranteed more than $388 billion in high-risk mortgage investments. Their large presence created an environment within which even mortgage-backed securities assembled by others could find a ready home.

The problem was that the trillions of dollars in play were only low-risk investments if real estate prices continued to rise. Once they began to fall, the entire house of cards came down with them.

Turning Point

Take away Fannie and Freddie, or regulate them more wisely, and it's hard to imagine how these highly liquid markets would ever have emerged. This whole mess would never have happened.

It is easy to identify the historical turning point that marked the beginning of the end.

Back in 2005, Fannie and Freddie were, after years of dominating Washington, on the ropes. They were enmeshed in accounting scandals that led to turnover at the top. At one telling moment in late 2004, captured in an article by my American Enterprise Institute colleague Peter Wallison, the Securities and Exchange Comiission's chief accountant told disgraced Fannie Mae chief Franklin Raines that Fannie's position on the relevant accounting issue was not even ``on the page'' of allowable interpretations.

Then legislative momentum emerged for an attempt to create a ``world-class regulator'' that would oversee the pair more like banks, imposing strict requirements on their ability to take excessive risks. Politicians who previously had associated themselves proudly with the two accounting miscreants were less eager to be associated with them. The time was ripe.

Greenspan's Warning

The clear gravity of the situation pushed the legislation forward. Some might say the current mess couldn't be foreseen, yet in 2005 Alan Greenspan told Congress how urgent it was for it to act in the clearest possible terms: If Fannie and Freddie ``continue to grow, continue to have the low capital that they have, continue to engage in the dynamic hedging of their portfolios, which they need to do for interest rate risk aversion, they potentially create ever-growing potential systemic risk down the road,'' he said. ``We are placing the total financial system of the future at a substantial risk.''

What happened next was extraordinary. For the first time in history, a serious Fannie and Freddie reform bill was passed by the Senate Banking Committee. The bill gave a regulator power to crack down, and would have required the companies to eliminate their investments in risky assets.

Different World

If that bill had become law, then the world today would be different. In 2005, 2006 and 2007, a blizzard of terrible mortgage paper fluttered out of the Fannie and Freddie clouds, burying many of our oldest and most venerable institutions. Without their checkbooks keeping the market liquid and buying up excess supply, the market would likely have not existed.

But the bill didn't become law, for a simple reason: Democrats opposed it on a party-line vote in the committee, signaling that this would be a partisan issue. Republicans, tied in knots by the tight Democratic opposition, couldn't even get the Senate to vote on the matter.

That such a reckless political stand could have been taken by the Democrats was obscene even then. Wallison wrote at the time: ``It is a classic case of socializing the risk while privatizing the profit. The Democrats and the few Republicans who oppose portfolio limitations could not possibly do so if their constituents understood what they were doing.''

Mounds of Materials

Now that the collapse has occurred, the roadblock built by Senate Democrats in 2005 is unforgivable. Many who opposed the bill doubtlessly did so for honorable reasons. Fannie and Freddie provided mounds of materials defending their practices. Perhaps some found their propaganda convincing.

But we now know that many of the senators who protected Fannie and Freddie, including Barack Obama, Hillary Clinton and Christopher Dodd, have received mind-boggling levels of financial support from them over the years.

Throughout his political career, Obama has gotten more than $125,000 in campaign contributions from employees and political action committees of Fannie Mae and Freddie Mac, second only to Dodd, the Senate Banking Committee chairman, who received more than $165,000.

Clinton, the 12th-ranked recipient of Fannie and Freddie PAC and employee contributions, has received more than $75,000 from the two enterprises and their employees. The private profit found its way back to the senators who killed the fix.

So: heads, the politicians win; tails, the taxpayers lose.

Via Ace of Spades.

Some inside details on "naked capitalism" check it out very interesting stuff going on. The market is not buying the bailout.

http://www.nakedcapitalism.com/2008/09/why-you-should-hate-treasury-bailout.html

The bailout hasn't happened yet. The market is reacting to Dems being in charge of the bailout pen. You'd know that if you were a Capitalist. Or if you knew the Democrats were responsible for the mess to begin with. Or if you weren't a Leftist. And if your first ride of pride had wheels instead of hoofs. Or a hundred other reasons. What did the poor Canadians ever do to you?

Darrell, I answer you thus: Rick Davis

And yeh I am not a capatilist, but if I entrusted someone with my cash and they gambled it away, I would not give them more money to gamble, and then turn around and justify it as a good investment. Duh!

Whats that Bush saying, fool me twice cause I am an idiot?

"Let the issues be the issue.

"Let the issues be the issue.

About Joy W. McCann: I've been interviewed for Le Monde and mentioned on Fox News. I once did a segment for CNN on "Women and Guns," and this blog is periodically featured on the New York Times' blog list. My writing here has been quoted in California Lawyer. I've appeared on The Glenn and Helen Show. Oh—and Tammy Bruce once bought me breakfast.

My writing has appeared in The Noise, Handguns, Sports Afield, The American Spectator, and (it's a long story) L.A. Parent. This is my main blog, though I'm also an alumnus of Dean's World, and I help out on the weekends at Right Wing News.

My political philosophy is quite simple: I'm a classical liberal. In our Orwellian times, that makes me a conservative, though one of a decidedly libertarian bent.

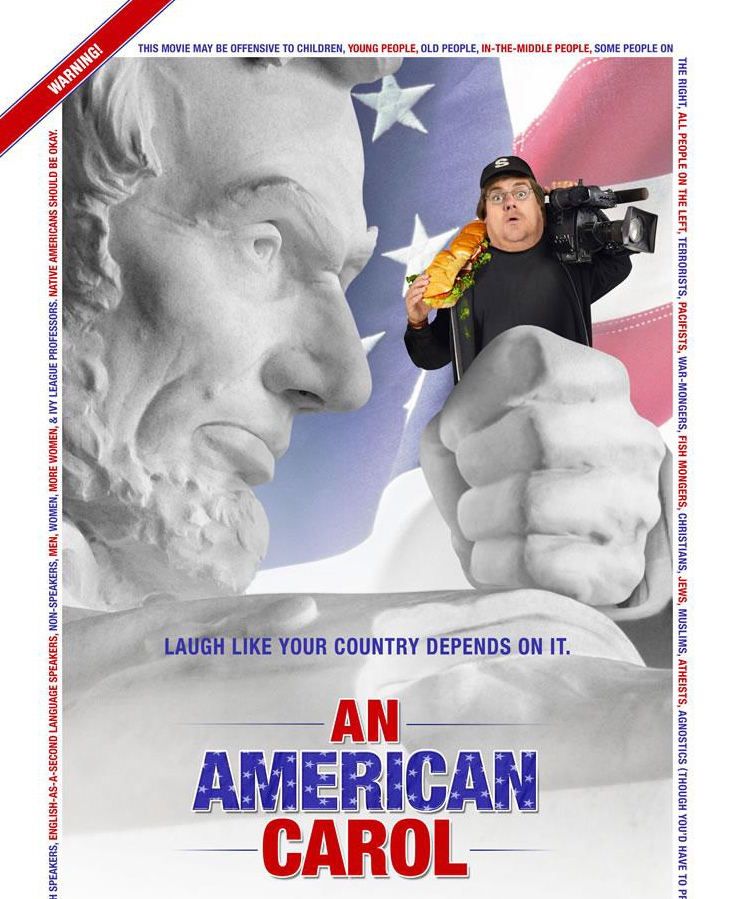

An American Carol rawks!

An American Carol rawks!Main AAC site (Warning: sound-enabled;

trailer starts automatically.)

Buy Blogads from the

Conservative

Network here.

This is one of the last pix

we took before we left

the house in La Caņada.

I think it's very flattering

to Bathsheba the .357.

"The women of this country learned long ago,

those without swords can still die upon them.

I fear neither death nor pain." —Eowyn, Tolkien's

Lord of the Rings

Free Abdulkarim al-Khaiwani!

Free Abdulkarim al-Khaiwani!See Jane Novak's "Yemeni Watch" blog,

Armies of Liberation.

Free journalists and dissident bloggers, worldwide!

Some of My Homegirls— ERROR: http://rpc.blogrolling.com/display_raw.php?r=59e4b55f70f50de810150859b200a635 is currently inaccessible

ENERGY RESOURCES:

• API (Information on Oil and Natural Gas)

• Natural Gas

• The California

Energy Blog

• The Alternative Energy Blog

(Solar, Wind, Geothermal, etc.)

• The Energy Revolution Blog

• Gas 2.0 Blog

• Popular Mechanics'

"Drive Green"

MOVIES & TELEVISION:

Criticism—

• Libertas

(now on hiatus, but they'll be back!) • Pajiba

Real Indie Productions—

• Indoctrinate U

(Evan Coyne Maloney)

• Mine Your Own Business

(Phelim McAleer)

• Expelled: No

Intelligence Allowed

(Ben Stein, Logan Craft,

Walt Ruloff, and John

Sullivan)

Real Indie Production

and Distibution

Companies—

• Moving Picture Institute

THE SAGA OF LIFE IN

THE R.H. HYMERS, JR., CULT:

• First Installment: The Basic Story

• Hymers' History of Violence

• How Fun Is It To

Be Recruited Into Hymer's

Offbeat Church? Not Very. • How I Lost My Virginity

THE LITTLE MISS

ATTILA SAMPLER:

On Food:

• Dreadful Breakfast Cookies

On Men and Women:

• It's Rape If

You Don't Send

Me Money

• Women Talk Too Much;

I'll Date Dolphins

• Heterosexual

Men Are Kinky

• Hot Cars,

Hot Girls

On Animation:

• Freakazoid!

—the Commentary

• Freakazoid!

DVD

On Religion:

• Athiests and

Christians Talking

To Each Other

TESTIMONIALS:

"Good grammar, and better gin."

—CalTech Girl

"I enjoy Little Miss Attila's essays."

—Venomous Kate

"Joy is good at catching flies with honey."

—Beth C

"Your position is ludicrous, and worthy of ridicule."

—Ace of Spades

"Sexy."

—RightGirl

"Old-school."

—Suburban Blight

HAWT LYNX:

Teh Funny—

• Dave Burge

Interesting News Items

Civics Lessons—

Taranto on How a Bill Becomes Law

Editorial Resources—

• Better Editor

• Web on the Web

• Me me me me me! (miss.attila --AT-- gmail --dot-- com)

Cigars—

• Cigar Jack

Science—

• David Linden/

The Accidental Mind

• Cognitive Daily

Rive Gauche—

• Hip Nerd's Blog

• K's Quest

• Mr. Mahatma

• Talk About America

• Hill Buzz

• Hire Heels

• Logistics Monster

• No Quarter

Food & Booze—

• Just One Plate (L.A.)

• Food Goat

• A Full Belly

• Salt Shaker

• Serious Eats

• Slashfood

Travel—

• Things You Should Do

(In the West)

• Just One Plate (L.A.)

Cars—

• • Jalopnik

The Truth About Cars

SoCal News—

• Foothill Cities

Oh, Canada—

• Five Feet of Fury

• Girl on the Right

• Small Dead Animals

• Jaime Weinman

Audio—

• Mary McCann,

The Bone Mama

(formerly in Phoenix, AZ;

now in Seattle, WA;

eclectic music)

• Mike Church,

King Dude

(right-wing talk)

• Jim Ladd

(Los Angeles;

Bitchin' Music

and Unfortunate

Left-Wing Fiddle-Faddle)

• The Bernsteins

(Amazing composers

for all your

scoring needs.

Heh. I said,

"scoring needs.")

Iran, from an Islamic Point of View

and written in beautiful English—

• Shahrzaad

Money—

• Blogging Away Debt

• Debt Kid

• Debtors Anonymous

World Services

• The Tightwad Gazette

Sex—

• Gentleman Pornographer

More o' Dat

Pop Culture—

• Danny Barer

(Animation News) • Something Old,

Nothing New

(And yet more

Animation News)

• Sam Plenty

(Cool New

Animation Site!)

• The Bernsteins

(Wait. Did I mention

the Bernsteins

already? They're

legendary.)

Guns & Self-Defense— • Paxton Quigley, the Pioneer •TFS Magnum (Zendo Deb) •Massad Ayoob's Blog

THE BLOGOSPHERE ACCORDING TO

ATTILA GIRL:

The American Mind

Aces, Flopping

Ace of Spades

Argghhh!!!

Armies of Liberation

Asymmetrical Information

Atlas Shrugs

Attila of Pillage Idiot

Beautiful Atrocities

The Belmont Club

The Bitch Girls

Bolus

Books, Bikes, and Boomsticks

The Common Virtue

Da Goddess

Danz Family

Dean's World

Desert Cat

Digger's Realm

Cam Edwards

Eleven Day Empire (James DiBenedetto)

Flopping Aces

Froggy Ruminations

Gay Orbit

Gregory!

Jeff Goldstein

Mary Katherine Ham

At the D.C. Examiner Hugh Hewitt

Hi. I'm Black.

Iberian Notes

IMA0

Iowahawk

The Irish Lass

In DC Journal

Infinite Monkeys

Instapundit

Intel Dump

Trey Jackson (videoblogging)

James Joyner

James Lileks

Rachel Lucas

Men's News Daily

Michelle Malkin

Nice Deb

No Watermelons Allowed

North American Patriot

On Tap

On the Fritz

On the Third Hand

Outside the Beltway

Oxblog

Peoria Pundit

Photon Courier

Power Line

The Protocols of

the Yuppies of Zion

Protein Wisdom

The Queen of All Evil

Questions and Observations

RightGirl

Right Wing News

Scrappleface

Donald Sensing

Rusty Shackleford

The Shape of Days

Sharp as a Marble

Sheila A-Stray

Laurence Simon

Six Meat Buffet

Spades, Ace of

Suburban Blight

TFS Magnum

This Blog is Full of Crap

Triticale

The Truth Laid Bear

Venomous Kate

VodkaPundit

The Volokh Conspiracy

Where is Raed?

Wizbang

Write Enough

You Big Mouth, You!

Support our troops; read the Milblogs!

| LinkGrotto |

|

Support a Blogger at the LinkGrotto.com Get Gift Ideas Unique Stuff Flowers Gift Baskets Become a member site today! |

Join the

Join the